Bybit Hacked: Inside the $1.5 Billion Crypto Heist

In one of the most audacious breaches in cryptocurrency history, Dubai-based exchange Bybit has confirmed that hackers stole approximately $1.5 billion worth of digital assets from its Ethereum cold wallet. The incident, which unfolded during what was meant to be a routine transfer between cold and warm wallets, has sent shockwaves throughout the crypto industry and raised critical questions about current security protocols.

The Anatomy of the Attack

According to Bybit’s CEO, Ben Zhou, the breach occurred when a seemingly ordinary transaction was manipulated. The attacker exploited a vulnerability in the user interface of the company’s multisignature cold wallet system—provided by the popular wallet provider Safe—to “mask” the true destination of the funds. In the manipulated transaction, signers saw what appeared to be a legitimate transfer, while the underlying smart contract logic was altered to divert approximately 400,000 Ethereum and associated tokens to an unidentified address.

“Bybit is solvent even if this hack loss is not recovered,” Zhou reassured customers via social media, adding that all client assets remain 1-to-1 backed and that the rest of the exchange’s wallets are secure. Withdrawal services have continued uninterrupted despite a surge in customer activity following the announcement.

Unprecedented Scale and Methodology

The scale of the heist dwarfs previous crypto breaches, with some reports comparing it to the infamous hacks of Poly Network and Binance. Blockchain analytics firms have noted that the stolen funds were quickly dispersed among dozens of wallets, complicating efforts to trace the illicit transfers. Some analysts have even linked the incident to sophisticated state-backed groups, with on-chain evidence pointing toward North Korea-linked Lazarus Group involvement, although investigations remain ongoing.

One particularly alarming detail uncovered by cybersecurity researchers relates to the multisig wallet’s underlying technology. Reports indicate that an anomaly involving identical transaction hashes across different networks—something that should be mathematically impossible—may have provided a window for the attackers. This finding has sparked a debate over the security measures built into widely used crypto wallet solutions and the potential for similar vulnerabilities to be exploited in the future.

Industry Impact and Response

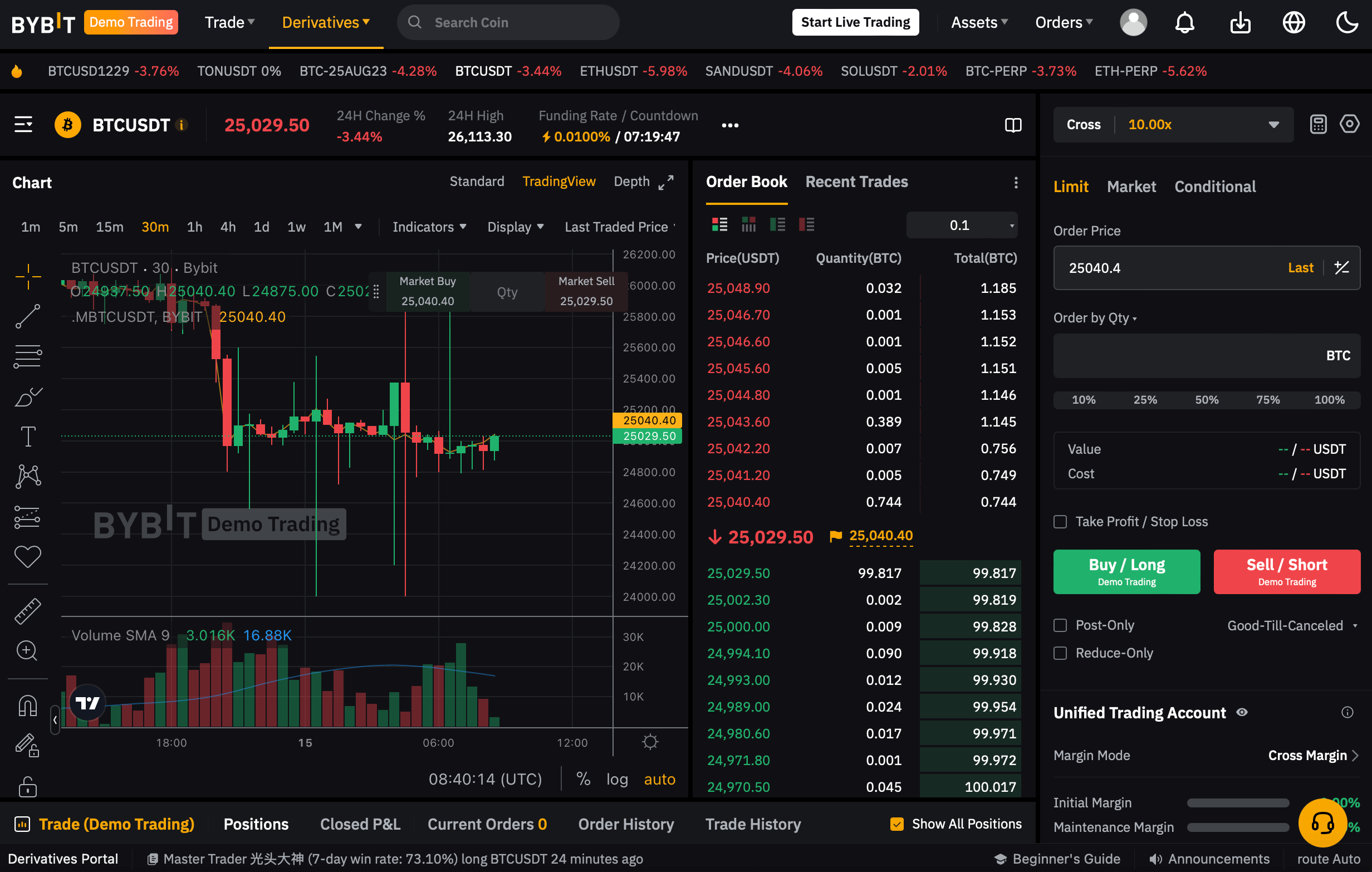

The Bybit hack comes at a time when the cryptocurrency market is already reeling from heightened volatility and regulatory uncertainty. In the wake of the attack, major digital assets such as Bitcoin, Ethereum, and XRP experienced notable declines, with traders reporting significant liquidations across futures markets. This incident, combined with other recent hacks that have collectively seen billions in funds disappear in the past year, underscores the persistent risks that continue to plague the crypto ecosystem.

Industry experts warn that while cold wallets are generally regarded as more secure than their hot counterparts, the breach at Bybit demonstrates that even the most robust systems can be compromised if attackers are able to manipulate the interface or exploit underlying contract logic. Many are now calling for a reassessment of multisig wallet security standards and urging institutions to adopt additional verification measures, such as raw-data payload audits, to prevent similar incidents in the future.

Forensic Investigations and Moving Forward

Bybit has mobilized its security team and partnered with leading blockchain forensic experts to trace the stolen funds. Preliminary investigations suggest that the funds are being funneled through a network of wallets, possibly to obfuscate the trail. While the recovery of the assets remains uncertain, Zhou’s assurances that the exchange remains solvent have provided a degree of reassurance to customers and market watchers alike.

The incident has also ignited broader concerns over crypto industry security. With over $2.2 billion lost to thefts in 2024 alone, the Bybit hack serves as a stark reminder that as the crypto market expands, so too does the ingenuity of cybercriminals. Regulators and industry leaders are now facing mounting pressure to institute more rigorous security protocols and to establish clearer guidelines to protect investor assets.

As investigations continue, the full ramifications of the Bybit hack are yet to be seen. What is clear, however, is that this breach represents a pivotal moment in the history of digital asset security—a wake-up call for the entire industry. In an environment where billions of dollars are at stake, even minor vulnerabilities can be exploited with devastating effect. Moving forward, enhanced security measures and greater transparency will be crucial in restoring confidence among users and ensuring the long-term stability of the cryptocurrency market.

No comments