Cronos Charts Ambitious Path to Tokenized Finance Dominance with Comprehensive 2025-2026 Roadmap

Cronos has unveiled an ambitious strategic roadmap for 2025-2026 that positions the blockchain network as a central infrastructure provider for the emerging tokenized asset economy. The comprehensive plan outlines three core growth engines designed to capture what the company describes as an "inflection point" in cryptocurrency adoption and on-chain finance.

🚀 Our 2025 - 2026 Roadmap is now live: The Golden Age of On-Chain Dominance. 🔗 Full roadmap: https://t.co/RqO0WzRiWG

— Cronos (@cronos_chain) August 26, 2025

🌕 Our vision is clearer than ever: turn global finance into open, programmable rails that ANYONE can use – newbies, DeFi degens, creators, builders,… pic.twitter.com/HTa8BI7Chg

The Foundation: Technical Upgrades Driving Early Success

The roadmap builds upon significant technical improvements already implemented on the Cronos network. By reducing the chain block time by a factor of 10 from 6s to 0.5s, and reducing the gas cost also tenfold, we have witnessed over 400% increase in daily transactions and 150% in daily active users, according to the announcement.

These performance enhancements serve as the technical foundation for Cronos's broader ambitions in the tokenized asset space, where speed and cost-efficiency are critical for institutional adoption and mainstream utility.

Strategic Pillar 1: Building AI-Native Tokenization Infrastructure

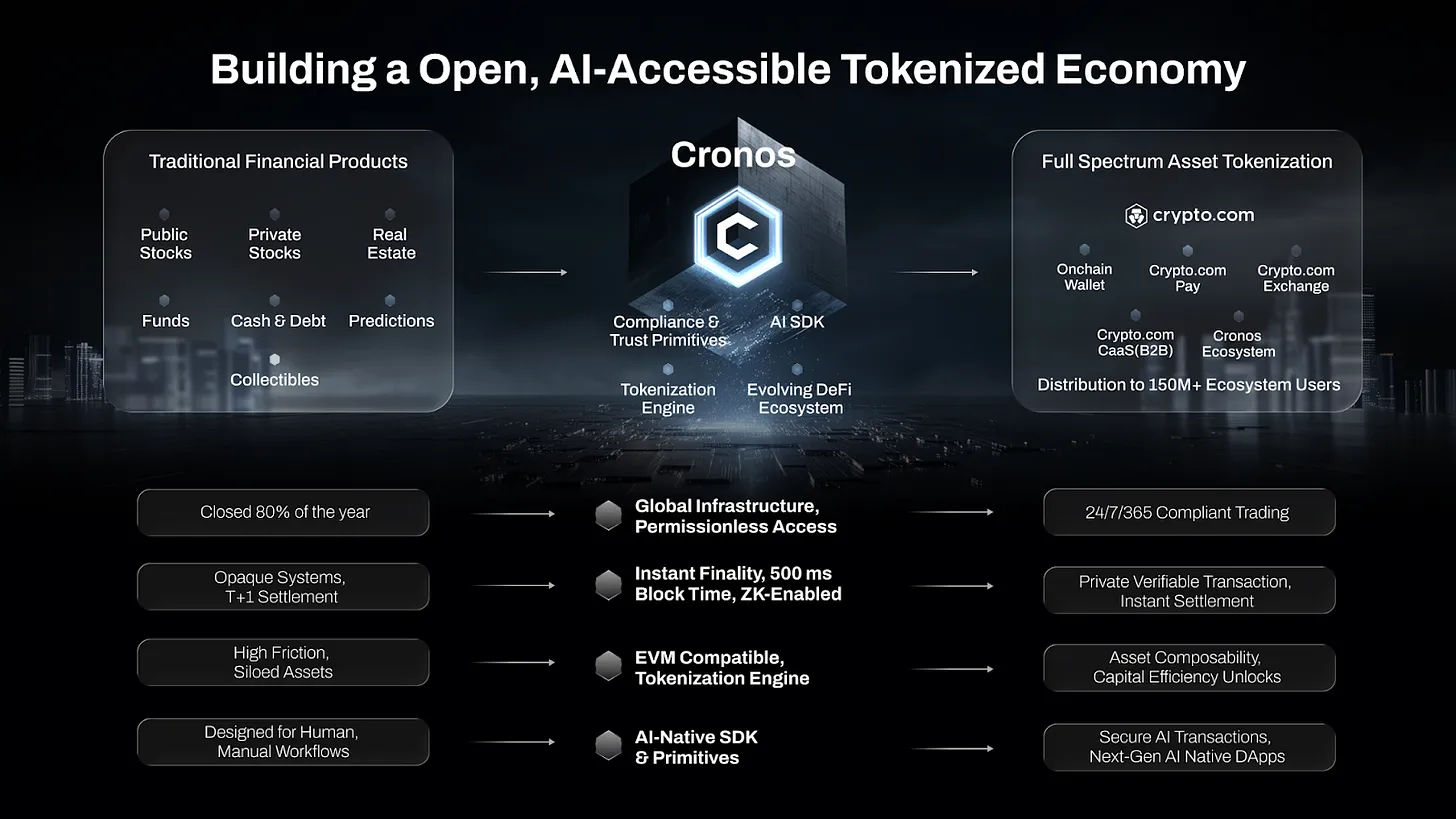

At the heart of Cronos's strategy lies a comprehensive tokenization platform designed to bring traditional financial assets onto the blockchain. The platform will support multiple asset classes, including equities, funds, commodities, insurance products, forex, and real estate.

What sets Cronos's approach apart is its focus on AI accessibility from the ground up. The network plans to launch an AI Agent SDK and implement a new Proof of Identity standard, enabling artificial intelligence systems to interact directly with tokenized assets and financial primitives on the blockchain.

From day one, our infrastructure will enable AI agents to build, trade, and collaborate with tokenized assets natively on-chain, the roadmap states. This positions Cronos ahead of the curve as the financial industry increasingly explores AI-driven trading and portfolio management solutions.

The tokenization infrastructure promises several key features:

- True on-chain ownership backed by regulatory licensing in major financial markets

- Enhanced utility, including instant T+0 settlement, yield generation on stocks, and lending capabilities

- Composability across existing and new decentralized applications

- 24/7 market access for traditionally time-restricted asset classes

Strategic Pillar 2: Leveraging Crypto.com's Massive Distribution Network

Cronos's partnership with Crypto.com represents a significant competitive advantage in driving adoption. The integration provides direct access to Crypto.com's extensive user base and merchant network, creating multiple pathways for mainstream adoption.

By integrating directly with Crypto.com, millions of users will be able to access Cronos lending, staking, and other on-chain services with zero friction, according to the roadmap. This integration encompasses several key areas:

- DeFi services for 150+ million users through seamless integration with Crypto.com's platform

- Payment infrastructure supporting over 10 million eligible merchants for direct on-chain transactions

- Institutional-grade liquidity leveraging Crypto.com's position as a leading exchange by spot volume, with established USD fiat rails

- AI-powered interfaces through Project Cortex, which will serve as a gateway for both humans and AI agents to access Cronos's financial services

Strategic Pillar 3: Capturing Institutional Demand Through Public Markets

Recognizing the growing institutional interest in cryptocurrency exposure, Cronos is actively supporting the development of exchange-traded funds (ETFs) and digital asset treasury companies focused on CRO, the network's native token.

The roadmap identifies several key partners in this effort, including 21Shares, Canary Capital, and Trump Media Technology Group, who are working to bring CRO ETFs to U.S. and European markets. Additionally, Cronos plans to support Digital Asset Treasury Companies (DATCOs) that include CRO in their investment strategies.

This institutional focus comes at a time of heightened corporate and institutional interest in cryptocurrency assets, with many companies adding digital assets to their balance sheets as treasury reserves.

Market Context: The Tokenization Opportunity

Cronos's ambitious plans emerge against a backdrop of rapidly growing interest in tokenized assets. Tokenization has exploded 200% in two years to $25B in assets – setting the stage for a $18T revolution projected by 2033, according to the roadmap document.

The stablecoin market, which has already demonstrated the potential of digital asset infrastructure, reaching a $271B market cap, provides a template for the broader tokenization opportunity that Cronos aims to capture.

Measurable Targets and Accountability

To ensure accountability and track progress, Cronos has established specific key performance indicators (KPIs) for 2026:

- $20 billion in CRO accumulated via public market rails

- $10 billion in real-world assets deployed in the ecosystem

- 20 million users across centralized and decentralized finance using Cronos infrastructure

These targets represent significant growth from current levels and would position Cronos as a major player in the tokenized asset ecosystem.

Technical Infrastructure and Compliance Focus

A critical component of Cronos's strategy involves meeting regulatory requirements across multiple jurisdictions. Assets grounded in real, hard-earned regulatory licensing in the most demanding financial markets in the world, endeavouring to meet stringent compliance standards in numerous jurisdictions across the world, the roadmap emphasizes.

This compliance-first approach addresses one of the primary barriers to institutional adoption of tokenized assets: regulatory uncertainty and the need for proper licensing and oversight.

Looking Forward: The Battle for On-Chain Finance

Cronos positions its roadmap as more than a development plan, describing it as not a roadmap — it's a battle plan. This framing reflects the competitive nature of the blockchain infrastructure space, where multiple networks are vying to become the foundation for the next generation of financial services.

The success of Cronos's ambitious plans will depend on execution across multiple fronts: technical development, regulatory compliance, partnership management, and user adoption. The network's existing relationship with Crypto.com provides a significant distribution advantage, but realizing the full potential of tokenized assets will require navigating complex regulatory landscapes and building trust with institutional users.

As the cryptocurrency industry matures and traditional finance increasingly explores blockchain integration, infrastructure providers like Cronos are positioning themselves to capture value from what could be a fundamental transformation in how financial assets are created, traded, and managed. The coming months will test whether Cronos can deliver on its ambitious vision of powering the golden age of on-chain dominance.

The roadmap includes forward-looking statements about future developments, and actual results may differ from projections. Investors should conduct their own research and consider risks before making investment decisions.

कोई टिप्पणी नहीं