Historic Bitcoin Whale Executes Massive $4.1B Portfolio Rotation Into Ethereum

The cryptocurrency market is witnessing one of the most significant portfolio rotations in its history, as a long-dormant Bitcoin whale systematically converts billions of dollars worth of Bitcoin into Ethereum. This unprecedented move is sending ripples through the digital asset ecosystem and may signal a broader institutional shift toward Ethereum as a preferred long-term investment vehicle.

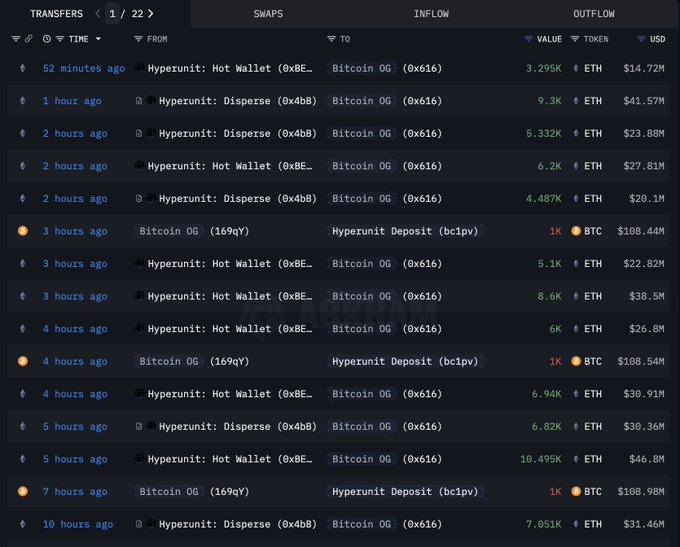

This Bitcoin OG has sold another 2,000 $BTC($215M) and bought 48,942 $ETH ($215M) spot over the past 4 hours.

— Lookonchain (@lookonchain) September 1, 2025

In total, he has bought 886,371 $ETH($4.07B).https://t.co/qtQdgPt2CQ pic.twitter.com/ymvyHyirFo

The Whale's Massive Bitcoin Holdings

On-chain analytics firm Lookonchain first identified the extraordinary trading activity in late August, tracking movements from a wallet that received over 100,000 Bitcoin approximately seven years ago. At the time of initial acquisition, this Bitcoin position was valued at roughly $642 million. Today, those same holdings would be worth over $11 billion, representing one of the most successful long-term cryptocurrency investments on record.

The timing of the original acquisition places this investor firmly in the "Bitcoin OG" category—early adopters who accumulated substantial positions during Bitcoin's formative years when institutional adoption was minimal and retail awareness remained limited.

Systematic Trading Strategy Unfolds

The whale's trading strategy has been methodical and sophisticated, demonstrating institutional-level execution across multiple platforms and trading mechanisms. Over a concentrated five-day period, the investor deposited approximately 22,700 Bitcoin to Hyperliquid, a decentralized derivatives platform, converting these holdings into nearly 500,000 Ethereum tokens.

The strategy extended beyond simple spot conversions. The whale simultaneously opened leveraged long positions exceeding 130,000 ETH, indicating confidence in Ethereum's short-term price trajectory and suggesting the spot purchases represented only one component of a broader trading thesis.

The execution continued with tactical precision: profitable long positions were systematically closed, with proceeds immediately reinvested into additional Ethereum spot purchases. Fresh Bitcoin deposits continued arriving at regular intervals, each transaction adding to an increasingly substantial Ethereum position.

As of the latest blockchain data, the whale now controls approximately 886,000 ETH valued at over $4 billion. The most recent activity shows continued momentum, with another 2,000 Bitcoin ($215 million) converted into 48,942 ETH in just four hours.

Understanding the Market Context

This massive portfolio rotation occurs against a backdrop of shifting momentum between Bitcoin and Ethereum. Recent performance metrics reveal a stark divergence between the two leading cryptocurrencies that may explain the whale's strategic decision.

Ethereum's Recent Outperformance

Ethereum has demonstrated remarkable resilience and growth over the past month, appreciating approximately 25% while Bitcoin declined roughly 4% during the same timeframe. This 29 percentage point performance differential represents one of the most significant periods of Ethereum outperformance in recent market history.

The outperformance isn't limited to price action. Ethereum has captured mindshare across multiple investor segments, from retail traders to institutional portfolio managers, creating a confluence of demand factors that may be driving sustained buying pressure.

Institutional Adoption Metrics

The institutional landscape provides compelling evidence for Ethereum's growing institutional acceptance. Spot Ethereum Exchange-Traded Funds (ETFs) in the United States now manage over $23 billion in assets under management, representing rapid institutional adoption since their launch.

These regulated investment vehicles have commanded significant investor attention, with flow patterns suggesting sustained institutional demand. The success of Ethereum ETFs contrasts with more moderate performance from Bitcoin-tracking funds, which have struggled to maintain comparable growth momentum.

Corporate Treasury Adoption

Perhaps more significantly, corporate adoption of Ethereum as a treasury asset has accelerated dramatically. Current market data indicates that approximately 71 companies now hold a combined 4.44 million ETH in their corporate treasuries, representing a total value of nearly $19.7 billion.

This corporate accumulation trend significantly outpaces Bitcoin's corporate adoption rate, suggesting that Chief Financial Officers and corporate treasurers increasingly view Ethereum as a legitimate treasury diversification tool. The steady growth in institutional ETH holdings reflects not just speculative interest, but strategic long-term positioning by entities with sophisticated risk management frameworks.

Broader Market Implications

Investment Flow Analysis

The institutional preference for Ethereum becomes even more apparent when examining regulated investment product flows. In mid-August, Ethereum led digital asset fund inflows with approximately $2.87 billion, capturing the majority of all cryptocurrency product inflows during that week.

These flow patterns suggest that when institutional investors allocate new capital to cryptocurrency exposure, they increasingly favor Ethereum over Bitcoin. This preference may reflect Ethereum's utility as a platform for decentralized finance, smart contracts, and emerging blockchain applications, rather than purely serving as a store of value.

Network Utility and Development Activity

Beyond investment flows, Ethereum's technical development and network utility continue expanding. The platform hosts the majority of decentralized finance protocols, non-fungible token marketplaces, and emerging Web3 applications. This utility-driven demand creates fundamental value propositions that extend beyond speculative trading.

Recent network upgrades, including the transition to proof-of-stake consensus and ongoing scalability improvements, have enhanced Ethereum's technical capabilities while reducing energy consumption—factors that may appeal to environmentally conscious institutional investors.

Technical Analysis of the Whale's Strategy

Risk Management Considerations

The whale's approach demonstrates sophisticated risk management through diversified execution methods. By utilizing both spot purchases and leveraged positions, the investor created multiple exposure vectors while maintaining flexibility to adjust position sizes based on market conditions.

The systematic closing of profitable leveraged positions and reinvestment into spot holdings suggests a strategy focused on building long-term exposure rather than short-term speculation. This approach indicates confidence in Ethereum's fundamental trajectory while managing the risks associated with leveraged trading.

Market Impact Assessment

Transactions of this magnitude inevitably influence market dynamics. The systematic nature of the trades, spread across multiple time periods and platforms, suggests deliberate efforts to minimize market impact while executing the rotation.

However, the sheer volume—nearly $4.1 billion in Bitcoin converted to Ethereum—represents meaningful selling pressure on Bitcoin and corresponding demand for Ethereum. These flows may contribute to the recent performance divergence between the two assets.

Regulatory and Market Structure Developments

ETF Performance Comparison

The performance differential between Bitcoin and Ethereum ETFs provides insight into current institutional preferences. While Bitcoin ETFs established the precedent for cryptocurrency ETF approval, Ethereum ETFs have demonstrated more consistent inflow patterns in recent months.

This trend suggests that institutional investors may view Ethereum's technological capabilities and development roadmap as more compelling than Bitcoin's primary value proposition as digital gold.

Regulatory Clarity

Increasing regulatory clarity around Ethereum, particularly following the Commodity Futures Trading Commission's designation of ETH as a commodity, has reduced regulatory uncertainty that previously concerned institutional investors. This clarity may be facilitating increased institutional allocation to Ethereum relative to other digital assets.

Future Market Dynamics

Potential Implications for Bitcoin

The whale's massive Bitcoin liquidation raises questions about potential selling pressure on Bitcoin markets. While the trades appear executed with minimal immediate market impact, the systematic nature suggests this rotation may continue.

If other early Bitcoin holders follow similar strategies, Bitcoin could face sustained selling pressure from long-term holders who are diversifying into Ethereum or other digital assets.

Ethereum Network Effects

Conversely, the massive Ethereum accumulation may create positive network effects. Large holders often participate in network governance, stake their holdings to secure the network, and provide stability during market volatility.

The whale's position—now representing approximately 0.7% of total Ethereum supply—could influence network dynamics and provide significant voting power in governance decisions.

Market Analysis and Investment Implications

Sector Rotation Dynamics

The whale's strategy may represent early evidence of a broader sector rotation within cryptocurrency markets. Just as traditional markets experience rotations between growth and value stocks, or between sectors, cryptocurrency markets may be experiencing rotation from store-of-value assets (Bitcoin) toward utility platforms (Ethereum).

This rotation could reflect maturing investor sophistication, with capital flowing toward assets perceived to have greater long-term utility and development potential.

Technical Indicators

From a technical analysis perspective, the whale's trading coincides with several positive indicators for Ethereum. Network activity remains robust, developer engagement continues growing, and institutional infrastructure development accelerates.

These fundamental factors, combined with favorable regulatory developments and institutional adoption metrics, may support the whale's apparent thesis that Ethereum represents superior long-term value relative to Bitcoin.

Conclusion: A Watershed Moment for Crypto Markets

The systematic conversion of over $4 billion in Bitcoin to Ethereum by one of the market's earliest and most successful investors represents more than just a large trade—it may signal a fundamental shift in how sophisticated cryptocurrency investors view the relative merits of different digital assets.

While Bitcoin established the foundation for cryptocurrency adoption and remains the largest digital asset by market capitalization, Ethereum's technological capabilities, institutional adoption metrics, and regulatory clarity appear to be attracting capital from even the most committed Bitcoin holders.

The whale's strategy—combining sophisticated execution, risk management, and systematic accumulation—provides a template that other large holders may follow. If this rotation represents the beginning of a broader trend rather than an isolated event, it could reshape the relative market positions of Bitcoin and Ethereum in the months ahead.

For market participants, this whale's actions serve as a compelling case study in cryptocurrency portfolio management and may offer insights into how institutional investors increasingly view the digital asset landscape. The systematic nature of the trades, combined with the investor's remarkable seven-year track record, suggests this rotation reflects careful analysis rather than speculative positioning.

As the cryptocurrency market continues maturing, the movement of capital from early Bitcoin adopters into Ethereum may mark a new phase of market development, where utility and technological capability increasingly drive investment decisions alongside traditional store-of-value considerations.

No comments