Oldest BTC Faucet FreeBitco.in Shuts Down After 12 Years: The End of an Era for Crypto Faucets

FreeBitco, one of the pioneering and most enduring cryptocurrency faucet platforms, has announced it will permanently shut down after operating for more than 12 years. The platform, which has served tens of millions of users since its launch in 2013, cited "widespread abuse across the website" as the primary reason for its closure—a decision that marks a significant moment in the history of cryptocurrency adoption tools.

In a message to users, the platform's operators revealed they are undertaking the complex process of separating legitimate users from abusers within their massive database. The shutdown will occur in phases, with the website being replaced by a shutdown page in the coming weeks, followed by a migration to a new database system, where verified, genuine users will be able to withdraw their remaining balances.

The timeline for withdrawals has been set for early 2026, acknowledging what the operators describe as "much longer than we are happy with." The delay stems from the manual review process required to examine each account individually—a labor-intensive undertaking given the platform's tens of millions of registered users.

The Rise and Legacy of FreeBitco.in

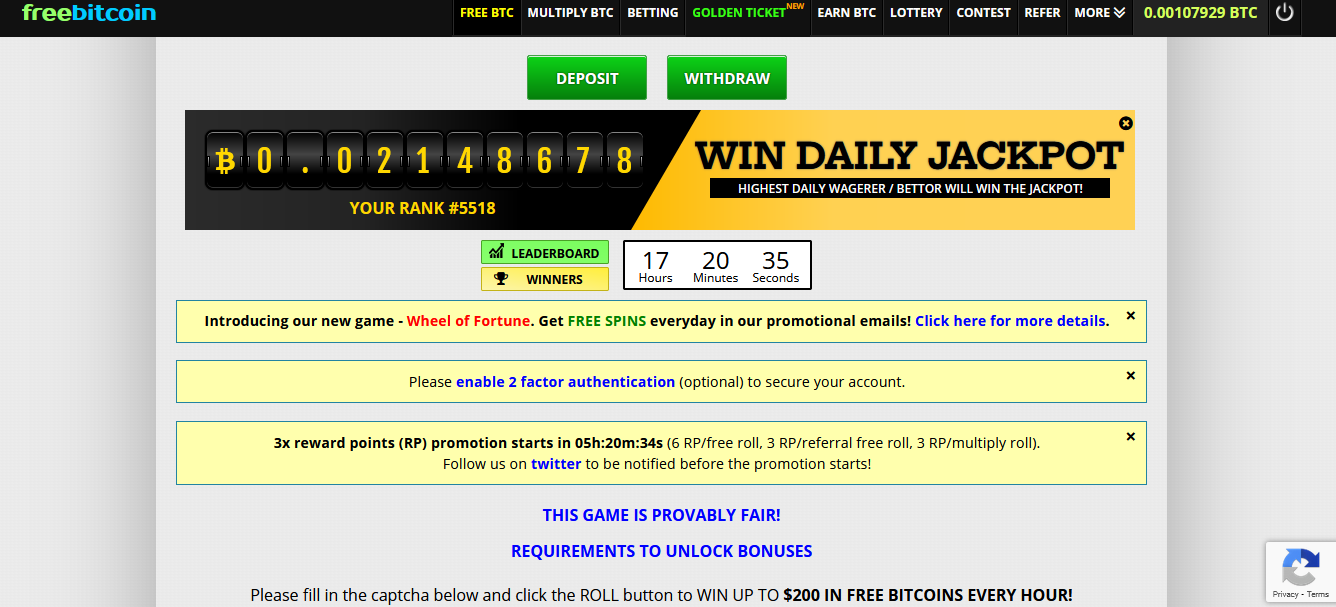

FreeBitco.in emerged during Bitcoin's early years when the cryptocurrency was valued at a fraction of today's prices. The platform operated on a simple premise: users could claim small amounts of Bitcoin at regular intervals by solving captchas, playing games, or participating in various activities. This "faucet" model served multiple purposes—introducing newcomers to cryptocurrency, distributing Bitcoin more widely, and building an engaged community around digital assets.

Over its 12-year lifespan, FreeBitco.in evolved beyond a simple faucet. The platform incorporated gambling features, interest-bearing accounts, lottery systems, and referral programs, creating a comprehensive ecosystem that kept users engaged while generating revenue through advertising and premium features. It became one of the most recognizable names in the faucet space, with millions of users claiming their first satoshis through the platform.

The Widespread Abuse Problem

While FreeBitco.in's shutdown announcement didn't detail specific abuse methods, the cryptocurrency faucet industry has long struggled with sophisticated exploitation tactics. Common abuse patterns include:

Bot Networks and Automation: Malicious actors deploy automated scripts and bot farms to claim rewards continuously, far exceeding legitimate human usage patterns. These operations can involve thousands of accounts operating simultaneously.

Multi-Account Fraud: Users create numerous accounts using different email addresses, proxy servers, and device fingerprints to multiply their earnings beyond platform limits.

Referral Manipulation: Exploiting referral programs by creating fake accounts to generate commissions, undermining the intended purpose of organic user growth.

Payment Processing Exploitation: Gaming withdrawal systems or exploiting vulnerabilities in payment processing to extract more value than earned.

The scale of this abuse on FreeBitco.in appears to have reached unsustainable levels, forcing operators to make the difficult choice between implementing increasingly restrictive countermeasures or shutting down entirely.

Why Many Crypto Faucets Are Closing

FreeBitco.in's closure reflects broader challenges facing the cryptocurrency faucet model, with numerous platforms ceasing operations in recent years. Several interconnected factors explain this trend:

Economic Viability Collapse: When Bitcoin traded at $200-$1,000, faucets could distribute meaningful amounts while maintaining profitability through advertising revenue. With Bitcoin now valued in the tens of thousands of dollars, the economics have fundamentally changed. The satoshis distributed must be so small that they lose appeal to users, or platforms operate at substantial losses.

Advertising Revenue Decline: The primary revenue source for free platforms—display advertising—has become less lucrative due to ad-blocker adoption, stricter privacy regulations, and reduced advertiser spending in the crypto sector. Meanwhile, operational costs, including hosting, anti-fraud systems, and customer support, have increased.

Regulatory Pressure: Cryptocurrency platforms face mounting regulatory scrutiny worldwide. Compliance requirements around know-your-customer (KYC) procedures, anti-money laundering (AML) protocols, and gambling regulations have made operating faucets more complex and expensive. Many faucet operators lack the resources to navigate this evolving landscape.

Sophisticated Fraud Evolution: As anti-abuse technology improves, so do exploitation methods. The perpetual arms race between platform operators and bad actors consumes significant resources, with diminishing returns for legitimate faucet operators.

Changing User Expectations: Modern cryptocurrency users have different needs than early adopters. With numerous ways to acquire small amounts of cryptocurrency—from exchanges offering minimal purchase requirements to educational rewards programs—traditional faucets have lost much of their original purpose.

Why Are Platforms Acting Now?

Several recent developments have accelerated faucet closures:

Post-Pandemic Economic Reality: The cryptocurrency industry experienced explosive growth during 2020-2021, followed by significant market contractions. This volatility has made sustainable business models more critical, exposing the fragility of advertising-dependent free services.

AI and Automation Advances: The rapid advancement of AI and machine learning has made abuse detection more sophisticated, but it has also empowered bad actors with better tools for exploitation. The balance has tipped unfavorably for platform operators.

Institutional Cryptocurrency Adoption: As Bitcoin ETFs launch and major financial institutions embrace cryptocurrency, the industry's focus has shifted toward institutional infrastructure rather than grassroots distribution methods like faucets.

Technical Debt Accumulation: Long-running platforms like FreeBitco.in carry significant technical debt. After 12 years, the effort required to modernize systems, implement new security measures, and maintain aging infrastructure may have become prohibitive.

Transaction Cost Realities: Bitcoin's increasing transaction fees make small withdrawals economically impractical. Users claiming small faucet rewards often find withdrawal fees exceed their balance, creating frustration and support burdens.

What's Happening Moving Forward?

The cryptocurrency ecosystem is evolving beyond the faucet model, with new mechanisms emerging for distribution and user acquisition:

Learn-to-Earn Programs: Platforms like Coinbase Earn reward users for completing educational modules, combining knowledge distribution with cryptocurrency introduction.

Web3 Gaming and NFTs: Play-to-earn games and NFT ecosystems provide engagement-based reward systems that offer more substantial value propositions than traditional faucets.

Decentralized Finance (DeFi) Incentives: Liquidity mining, staking rewards, and yield farming have become the new "faucets" for users seeking to earn cryptocurrency, though they require initial capital investment.

Social Token Airdrops: Projects distribute tokens directly to engaged community members, early adopters, or existing cryptocurrency holders through sophisticated airdrop campaigns.

Lightning Network Micro-Transactions: Bitcoin's Lightning Network enables extremely small transactions with minimal fees, potentially enabling a new generation of micro-payment services, though consumer adoption remains limited.

Case Study: The FreeBitco.in Shutdown Process

FreeBitco.in's approach to closure offers insights into the complexity of shutting down a major cryptocurrency platform:

Phased Shutdown Timeline: Rather than immediately closing, the platform implemented a structured wind-down process, allowing time for user verification and fund recovery.

Manual Review Necessity: The decision to manually review tens of millions of accounts reveals the limitations of automated fraud detection systems, even after years of operation.

Extended Withdrawal Period: Setting withdrawals for early 2026—potentially over a year from the announcement—demonstrates the scale of the challenge in separating legitimate balances from fraudulent claims.

Communication Transparency: The platform's direct communication about abuse problems and timeline challenges represents responsible handling compared to platforms that simply disappear.

Fund Security Assurance: Emphasizing that legitimate users' funds remain safe addresses the primary concern during platform shutdowns, though the extended timeline will test user patience.

This methodical approach contrasts with numerous cryptocurrency platforms that have closed abruptly, leaving users with no recourse. However, the lengthy timeline also creates uncertainty and potential risks.

User Implications and Advice

For FreeBitco.in users, the operators have issued clear guidance:

- Do not send additional deposits to the platform, as these may require manual crediting after shutdown completion

- Monitor communications from the platform regarding the verification process

- Maintain account access information to facilitate eventual withdrawal

- Exercise patience as the manual review process unfolds over the coming months

For the broader cryptocurrency community, this shutdown serves as a reminder to:

- Diversify holdings across multiple platforms and services

- Withdraw regularly rather than accumulating large balances on third-party platforms

- Self-custody funds when possible, particularly for significant amounts

- Research platform sustainability before investing time or money

The Broader Context: Faucets in Cryptocurrency History

Cryptocurrency faucets played a crucial role in Bitcoin's early distribution and adoption. Gavin Andresen, an early Bitcoin developer, created the first Bitcoin faucet in 2010, distributing five Bitcoins per person when they were nearly worthless. This initial model helped thousands of people obtain and experiment with cryptocurrency without financial barriers.

FreeBitco.in represented the evolution of this concept into a sustainable business model—for a time. Its longevity made it an outlier in an industry where most faucets operate briefly before closing. The platform's shutdown thus marks not just one service ending, but potentially the conclusion of the faucet era itself.

Industry Reactions and Future Outlook

The cryptocurrency faucet model that once served as a primary gateway for newcomers has largely outlived its usefulness in the modern crypto ecosystem. While some niche faucets continue operating, particularly for newer cryptocurrencies seeking distribution, the economic and operational challenges facing established platforms like FreeBitco.in suggest this trend will continue.

Alternative distribution methods have proven more effective at combining user acquisition with sustainable business models. Educational platforms provide value beyond simple rewards, gaming applications create genuine engagement, and DeFi protocols offer meaningful economic participation rather than trivial amounts.

The shutdown of FreeBitco.in after 12 years of operation represents the end of an era—but also the maturation of an industry that has outgrown its earliest distribution mechanisms. As cryptocurrency becomes increasingly mainstream, the need for faucets diminishes while the challenges of operating them multiply.

For tens of millions of users who received their first satoshis through FreeBitco.in, the platform served its historical purpose: introducing people to cryptocurrency and demonstrating blockchain technology's practical applications. That legacy endures even as the service itself prepares to close its digital doors.

The coming months will test whether the platform can successfully execute its complex shutdown plan and return funds to legitimate users—a final challenge that will determine whether FreeBitco.in's legacy remains positive or becomes a cautionary tale about the risks of centralized cryptocurrency services.

Users with balances on FreeBitco.in should monitor official communications from the platform and prepare for the withdrawal process expected to begin in early 2026. The cryptocurrency community continues to develop new models for distribution and adoption as the industry evolves beyond its faucet origins.

No comments