Pump.fun's $4 Billion Token Launch Faces Another Delay Amid Mounting Legal Challenges

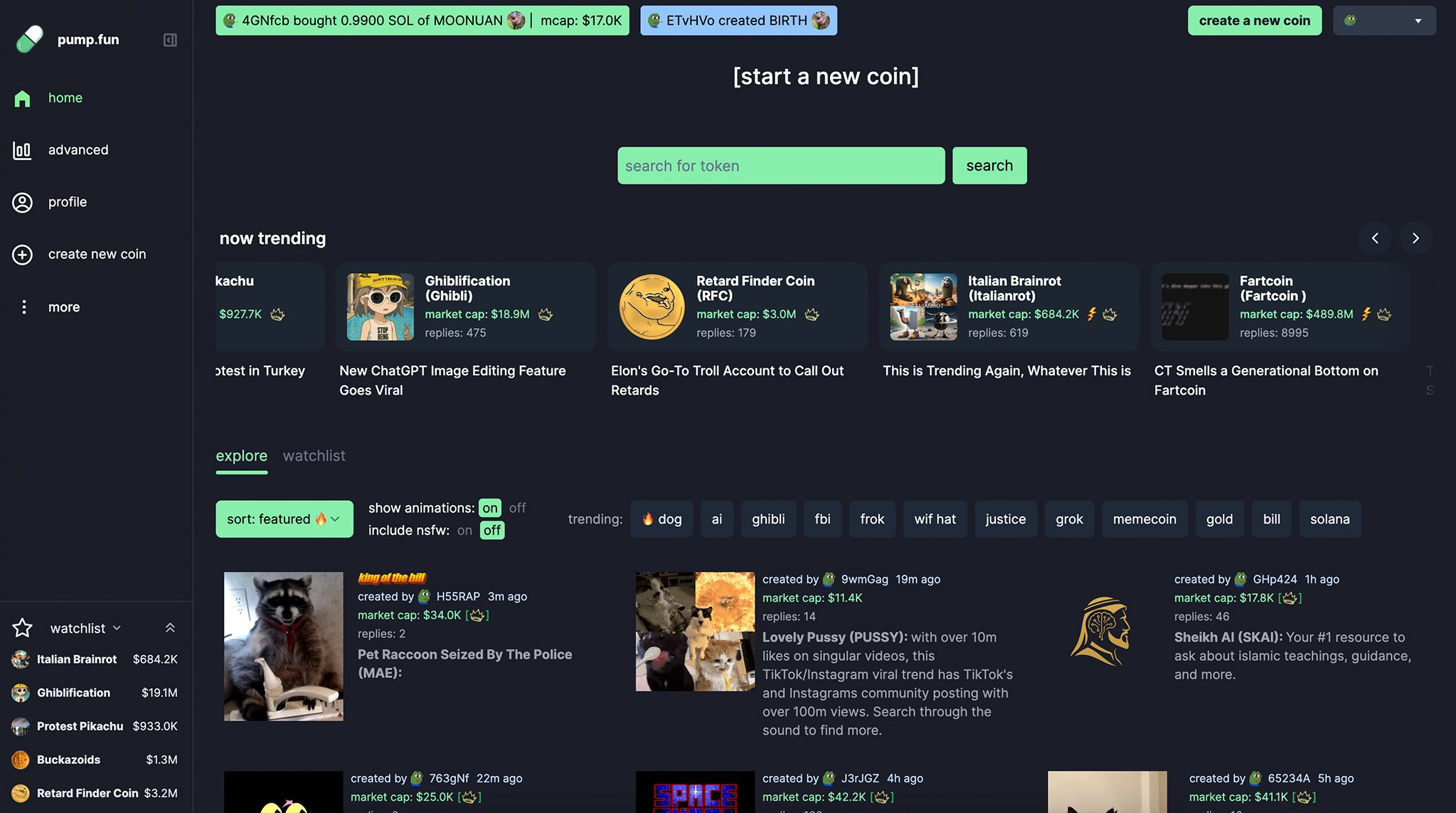

The Solana-based memecoin launchpad Pump.fun has once again postponed its highly anticipated public token sale, pushing back what was set to be one of the cryptocurrency industry's largest fundraising events. The platform, which has become synonymous with the memecoin phenomenon, was originally scheduled to conduct its token auction on June 25, targeting a $1 billion raise at a $4 billion valuation.

The Latest Postponement

According to reports that emerged on Friday, Pump.fun has delayed its public token sale yet again, with the team now expecting the auction to take place in mid-July. This marks another setback for a project that has seen multiple delays since planning began in 2024. While the company has not provided specific reasons for this latest postponement, the timing coincides with escalating legal troubles across multiple jurisdictions.

Exclusive: The Pumpfun token auction and listing, originally scheduled for June 25, has been postponed again and is now expected to take place in mid-July.

— Wu Blockchain (@WuBlockchain) June 20, 2025

Sources familiar with the matter disclosed that since Pumpfun began planning to issue and auction tokens late last year,… pic.twitter.com/UD0xIb45FA

The delay affects what would have been a landmark event in the cryptocurrency space. Few platforms have achieved the scale and influence that Pump.fun has garnered in the memecoin sector, making its token launch one of the most watched developments in the industry. The platform has been responsible for more than 70% of token launches on the Solana network, demonstrating its dominant position in the ecosystem.

A Complex Web of Legal Challenges

The postponement comes as Pump.fun faces an increasingly complex legal landscape. The platform has been hit with multiple proposed class action lawsuits, with attorneys alleging that the company and its executives have collected nearly $500 million in fees while violating U.S. securities laws.

The most prominent legal challenge emerged in January 2025, when Burwick Law first served Pump.fun with a class action lawsuit, accusing the platform of various forms of misconduct. The allegations center on claims that Pump.fun has been operating as an unlicensed securities exchange, facilitating the sale of unregistered securities through its memecoin creation platform.

The lawsuits allege that Pump.fun has breached securities regulations by failing to register tokens with the U.S. Securities and Exchange Commission (SEC). Legal experts have noted that the case could set important precedents for how memecoin platforms are regulated, particularly regarding whether user-generated tokens constitute securities under federal law.

The Securities Violation Claims

The legal arguments against Pump.fun are multifaceted. Attorneys assert that all tokens created on Pump.fun's platform should be considered securities, which would require the platform to comply with extensive federal registration and disclosure requirements. This interpretation, if upheld by courts, could fundamentally alter how memecoin platforms operate.

According to the lawsuit filed in January, the platform has attracted nearly $500 million in fees by marketing unregistered, highly-volatile memecoins. The complaint suggests that Pump.fun's business model inherently involves securities violations, as it facilitates the creation and trading of investment contracts without proper regulatory oversight.

The legal challenges extend beyond traditional securities law. Burwick Law has also demanded that Pump.fun remove tokens that allegedly impersonate the law firm itself, highlighting issues around intellectual property infringement and platform content moderation.

Platform Response and Defense Strategy

Recognizing the severity of the legal challenges, Pump.fun has recently strengthened its legal team with fresh hires to fight the Burwick lawsuit, tapping high-profile lawyers to battle the claims. This legal reinforcement suggests the company is preparing for a protracted legal battle that could significantly impact its operations and future plans.

The platform's defense strategy appears to focus on challenging the fundamental premise that memecoins created through its platform constitute securities. Legal experts note that this argument hinges on complex interpretations of the Howey Test, the legal standard used to determine whether an asset qualifies as a security under U.S. law.

Broader Industry Implications

The legal troubles facing Pump.fun reflect broader regulatory uncertainty in the cryptocurrency industry, particularly around decentralized finance platforms and user-generated content. The case could establish important precedents for how platforms that facilitate peer-to-peer token creation are regulated.

The memecoin sector, which has experienced explosive growth over the past year, now faces potential regulatory constraints that could reshape how these platforms operate. Industry observers note that the outcome of Pump.fun's legal battles could influence regulatory approaches to similar platforms across the cryptocurrency ecosystem.

Social Media Disruptions

Adding to the platform's challenges, Pump.fun also faced a temporary social media ban when X (formerly Twitter) suspended the accounts of both the platform and its founder on June 16, before reinstating them a few days later. While neither X nor Pump.fun provided explanations for the suspension, the incident occurred alongside similar temporary suspensions of other cryptocurrency platforms.

The social media disruption, while brief, highlighted the platform's dependence on major social media channels for user engagement and marketing. The timing of the suspension, coinciding with the legal challenges, has led to speculation about potential coordination between regulatory authorities and social media platforms, though no evidence of such coordination has been presented.

Market Impact and Future Outlook

The repeated delays of Pump.fun's token launch has created uncertainty in the broader memecoin market. The platform's token was expected to be a significant event that could influence valuations across the sector. The postponement has left investors and industry observers questioning when, or if, the launch will ultimately proceed.

The legal challenges facing Pump.fun also reflect broader questions about the sustainability of the memecoin phenomenon. As regulatory scrutiny intensifies, platforms in this sector may need to fundamentally alter their business models to comply with securities laws.

Looking Ahead

As Pump.fun navigates its legal challenges, the outcome of these cases will likely have far-reaching implications for the cryptocurrency industry. The platform's ability to resolve its legal issues while maintaining its dominant market position will be closely watched by competitors, regulators, and investors alike.

The July timeline for the token launch remains tentative, contingent on the resolution of ongoing legal matters. Industry experts suggest that successful completion of the token sale may require significant changes to the platform's structure and operations to address regulatory concerns.

The case serves as a reminder of the evolving regulatory landscape in cryptocurrency, where innovative platforms must balance rapid growth with compliance requirements that continue to develop alongside the technology itself.

No comments